Cryptocurrency has grown exponentially since their creation in 2009, with total cryptocurrency market capitalization currently standing at over $ 650 billion. While growth has been strong, the overall cryptocurrency market capitalization is still only a fraction of Gold or US Equity - which itself is only a small part of the global stock investment market. There is still room for considerable growth. There are now thousands of cryptocurrencies to choose from, with more appearing every day.

Crippling options - options add cost, complexity, and need for suggestions. High risk, extreme volatility and practical difficulties to make purchasing and storing an effective and diverse coin portfolio (cryptocurrency) are a complex issue.

FUND PORTFOLIO AND FUND STRUCTURE: Definition: Open Mutual Funds - Open-end funds are mutual funds that issue unlimited investment shares in stocks and / or bonds. Investment creates more stocks, while selling stocks takes them out of circulation. Shares are purchased and sold on demand with their net asset value, which is based on the value of the underlying securities of such funds and is calculated at the end of the trading day. When a large number of shares are redeemed, funds can sell part of their investment to pay investors. Shares are purchased directly from the fund administrator.

Exchange-traded fund (ETF) - An exchange-traded fund is like an open-ended mutual fund but traded as a common stock in the stock market. It is not purchased directly from the fund administrator. ETFs can trade at a premium or discounted price to the NAV but this is often very short due to arbitrage by institutional investors.

Closed funds (CEF) - Closed funds are the once-off seeds through an IPO and then traded on the exchange thereafter. No further shares are issued and the CEF may trade above the net asset value because buying and selling shares on the exchange has no effect on underlying assets.

Smarter Than Crypto is autonomous; crypto Accounted Managed Account is cheap which will have zero cost management. The tokenized portfolio is the first SMARTER THAN BETA portfolio that provides solutions to Index issues. Generally, in traditional investments, 60% of the assets refer to the Index. For Smarter than Crypto, the goal is to outperform the index in the crypto world and provide 40% return and 40% less risk.

Smarter Than Crypto will act as a utility token, representing the percentage of the Crix-Crypto index. Tokens will only be accessible via ICO. The amount of coins you buy will represent your portfolio portion. In return, the platform will buy the underlying cryptocurrency through your ICO contributions. The wise thing to note is the closing ICO which means it is a one-time event to get the token before the entire project begins. Their innovative price floor mechanism will also work by implementing blockchain technology for smart contracting during the initial phase. The original agreement will facilitate transactions and fess on the SMARTER platform of CRYPTO.

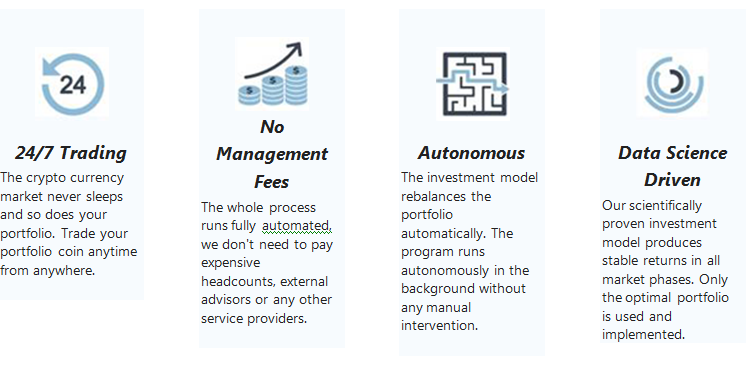

Smarter Than Crypto Excellence: No management fees-Transactions in Smarter than Crypto will run on fully automated systems that do not require expensive service providers or external advisors; Autonomous-platform investment model automatically balances portfolio through return and risk mode. No manual intervention is needed because the program runs in the background.

Non-stop trading-automated system allows to trade 24/7 through portfolio. Users can trade whenever they want, anywhere; Scientifically proven-the investment model is said to be scientifically proven to produce stable returns by ensuring optimal portfolio; Easy and simple - the portfolio will include a range of cryptocurrencies with the top 20 already confirmed for display in the list; Closed Cap - A one-time sale of tokens will only allow for the issuance of fixed coins and crypto trade prohibited outside the portfolio.

Smarter Than Crypto has applied the industry's best security practices for defense against Sybil and malicious actors in collaboration with our expert advisory team. Strong identity verification and authentication procedures exist to ensure safe operation. The contract codes have been intelligently audited thoroughly for vulnerabilities, confirmation of operations as described in this White Book, static and manual analysis of smart contracts, gas analysis and verification of deployment procedures. Transparency in Smarter Than Crypto trading activities and current ownership will be guaranteed through the use of exchange APIs only see as well as through proof of reserves for non-exchangeable wallets (this includes hot and cold wallets).

Because Smarter Than Crypto is unknown and full investment is restricted not being forced, the front runner will not have the information to anticipate the reallocation of the portfolio. Additionally some strategies will be used to mitigate this risk: 1) Cryptocurrency will be sent to exchange 1-24 hours before trading so traders can not follow hot purses to know exactly when a purchase or sale will be made. A weekly balancing window gives ample time to do this; 2) Trading will be executed through several exchanges; 3) Trading will be executed at different times in the rebalance window to prevent predictability.

Smarter Than Crypto will be automated through API integration with multiple exchanges, possibly including but not limited to: Bitstamp, Bitfinex, BTer, Bittrex and Poloniex. A full list of exchanges used will be available on our website when trading begins. Additional exchanges will be added when checked and the API with sufficient minimum functionality is available.

The Smarter Than Crypto team will invest significant time and effort into post-ICO marketing targeted to investors in the traditional financial sector through the production of information sheets, explanatory videos and easy-to-understand planning documents. Token holders will be able to view detailed information about their ownership and portfolio composition on the Smarter Than Crypto website. Smarter Than Crypto will focus its marketing efforts only on unregulated markets. No promotions or solicitation will be made where participation is prohibited or may be prohibited in the near future to remain in compliance with local law.

The weighted (20% max cap) SMARTER THAN BETA strategy outperformed the strategy of the top 20 based on market capitalization, with weekly balancing generating 40% more returns with 40% lower risk than the benchmark index without allowing one asset (and thus one source of risk) to dominate. Smarter Than Crypto and especially Smarter Than Crypto are ready to set new standards for cryptocurrency investment. As a transparent, secure and asset-as-a-portfolio transparent, Smarter Than Crypto aims to bring a 0% management cost, crypto investment exposes the broad market to the mainstream with an innovative single token offering.

Smarter Than Crypto comes in the form of a digital currency named STC. The STC Token will go on sale from 13 May 2018 to 10 June 2018, at a price of 1 STC equivalent to 1 USD. The purchase of token itself can be done with foreign digial currency such as ETH, BTC and LTC. Do not forget, get also purchase bonuses at certain time period.

Smarter Than Crypto itself is the result of teamwork led by Oliver Prock, Smarter Than Crypto strives to provide their best capabilities in this project. In addition, the team also strives to provide the best benefits and services, to anyone interested in joining the project.

STC has been designed and created by a team of highly experienced technology experts. Team members bring together expertise that gives them an in-depth understanding of the challenges many crypto companies face including legal, regulatory and compliance issues.

So our ICO project review this time, hopefully can increase your knowledge in choosing the best project ICO to you invest. If you are interested in joining this project, or intend to buy a token in the sale. You can visit their official website and page below:

0 komentar: